Gold365 ID Review: How the Platform Transforms Gold Investment in India

In a market where gold has long been a symbol of wealth and security, the digital revolution has introduced new ways to own, trade, and store this precious metal. Gold365 ID stands out as a cutting‑edge platform that blends technology with trust, offering Indian investors a seamless experience from purchase to redemption. This article examines the key features of Gold365 ID, its partnership with Laser247, and why it may be the right choice for both new and seasoned gold enthusiasts.

Why Digital Gold Matters

Traditional gold buying involves physical bars, coins, or jewelry, each with its own logistical challenges—storage, insurance, and authenticity verification. Digital gold removes these hurdles by allowing investors to hold a gram‑equivalent of gold in an electronic ledger. The benefits are clear:

- Instant Liquidity: Sell or convert holdings at any time through the platform’s marketplace.

- Secure Storage: Gold is kept in vaults that meet international security standards.

- Transparent Pricing: Real‑time market rates ensure you receive fair value.

- Low Entry Barriers: Purchase as little as 0.1 gram, making gold investment accessible to a broader audience.

Gold365 ID leverages these advantages while adding its own unique layers of convenience and reliability.

Core Features of Gold365 ID

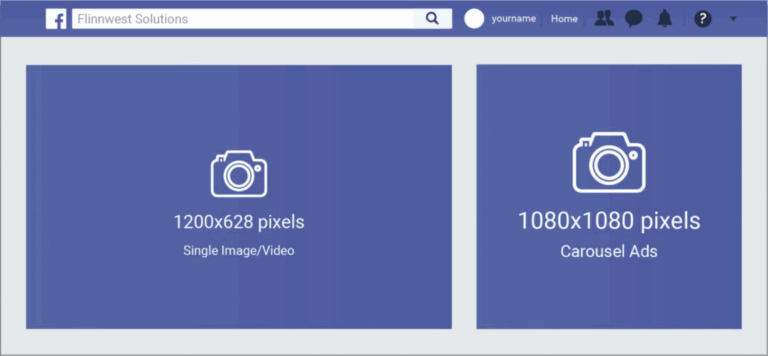

1. User‑Friendly Interface

The platform’s dashboard is designed for clarity. New users can navigate the purchase process with step‑by‑step prompts, while experienced traders benefit from advanced charting tools and instant order execution.

2. Real‑Time Pricing Engine

Gold365 ID syncs with leading global commodities exchanges to fetch live rates. This ensures that the price you see at checkout reflects the current market, eliminating hidden spreads.

3. Secure Custodial Services

All gold held on behalf of users is stored in high‑security vaults located in reputed international facilities. The partnership with Laser247, a company known for its precision engineering and secure logistics, adds an extra layer of protection, especially for the physical redemption process.

4. Easy Redemption Options

Investors can convert their digital holdings into physical gold bars or coins, delivered directly to their doorstep or a selected vault. The redemption process is streamlined, with clear tracking and insurance coverage throughout transit.

5. Regulatory Compliance

Gold365 ID operates under the oversight of the Reserve Bank of India (RBI) and adheres to KYC/AML standards. This compliance builds confidence for users wary of the unregulated dark corners of digital finance.

The Strategic Role of Laser247

While Gold365 ID manages the digital aspects—transactions, account management, and market integration—Laser247 focuses on the physical side of the ecosystem. Their expertise in precision logistics ensures that when a user requests a redemption, the gold reaches its destination safely and promptly. Laser247’s state‑of‑the‑art tracking systems and temperature‑controlled vaults minimize risks such as theft, tampering, or degradation.

This collaboration exemplifies how fintech and logistics can converge to create a trustworthy end‑to‑end gold investment experience. By relying on Laser247’s infrastructure, Gold365 ID can promise users both the convenience of a digital platform and the tangible assurance of physical gold.

Benefits for Different Investor Profiles

New Investors

For those dipping their toes into precious metals, Gold365 ID offers a low‑cost entry point and educational resources, including webinars and market insights. The ability to start with a fractional gram removes the financial intimidation often associated with gold purchases.

Seasoned Traders

Experienced investors appreciate the platform’s real‑time trading tools, API access for algorithmic strategies, and the option to set automatic buy or sell triggers based on price movements.

Long‑Term Wealth Builders

Individuals focused on wealth preservation can utilize Gold365 ID’s automatic portfolio rebalancing, ensuring their gold allocation stays aligned with long‑term goals as market conditions shift.

Security Measures You Should Know

Security is paramount when dealing with high‑value assets. Gold365 ID employs a multi‑layered approach:

- Two‑factor authentication (2FA) for account access.

- End‑to‑end encryption for data transmission.

- Regular third‑party security audits.

- Segregated vault storage using Laser247’s compartmentalized systems, preventing cross‑contamination of assets.

These protocols safeguard both digital records and physical gold, giving investors peace of mind.

How to Get Started

- Visit the official website at Gold365 ID and click “Sign Up”.

- Complete the KYC verification by uploading a government ID and proof of address.

- Link your bank account or preferred payment method.

- Choose the amount of gold you wish to purchase and confirm the transaction.

- Monitor your holdings via the dashboard, or schedule a redemption if you prefer physical gold.

The entire onboarding process typically takes less than 15 minutes, and customer support is available 24/7 to assist with any queries.

Conclusion

As India’s appetite for gold continues to grow, the need for secure, convenient, and transparent investment solutions becomes ever more critical. Gold365 ID meets this demand by uniting a sophisticated digital platform with the logistical expertise of Laser247. Whether you are a first‑time buyer, a professional trader, or a long‑term saver, the platform’s blend of technology, compliance, and physical security makes it a compelling choice for modern gold investors.

By offering real‑time pricing, fractional ownership, and a trustworthy redemption pathway, Gold365 ID is not just another fintech app—it is a comprehensive ecosystem designed to keep your gold investment safe, liquid, and profitable.